Enhancing Financial Inclusion

Enhancing Financial Inclusion: The Role of Mombo Sacco Goal Savings Accounts in Kenya Introduction Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that

In recent years, Kenyans have embraced a wide array of financial options to grow their wealth and secure their financial futures. Two popular choices standout—Mombo Sacco Goal Savings Accounts and Forex trading. Each offers unique opportunities and risks, tailored to different financial strategies and lifestyles. Understanding the nuances between these options can aid in making informed decisions aligned with individual or business financial goals.

Understanding Mombo Sacco Goal Savings Accounts

Mombo Sacco’s Goal Savings Accounts are tailored to help individuals and groups realize specific financial objectives. These accounts provide flexibility in setting short-term and long-term saving goals, with competitive profit rates that are designed to cater to the diverse needs of savers. The accounts offer structured saving solutions like Sprint Goal Accounts for short-term savings needs and Marathon Goal Accounts for long-term aspirations, with profit rates reaching as high as 12% per annum.

For those seeking a conservative, low-risk savings option in Kenya, Mombo Sacco Goal Savings Accounts deliver predictability and security. This is particularly appealing to individuals aiming for systematic saving for plans such as education, real estate purchase, or business expansion, providing a steady basis for accumulating wealth without the volatility inherent in more speculative investments.

Exploring Forex Trading

Forex trading, or foreign exchange trading, involves the buying and selling of currencies in the global market. This form of investment is highly popular in Kenya, fueled by increased access to online trading platforms and the potential for significant returns. Forex trading is dynamic and can present substantial profit opportunities over short periods. It appeals to investors who are willing to engage with high-risk activities in the pursuit of high rewards.

Forex is inherently volatile and is subject to factors like geopolitical events, market sentiment, and economic indicators which can swing currency values dramatically. For seasoned traders who possess expertise in market analysis or have access to high-quality brokerage services, Forex provides an enticing albeit risky method to generate wealth quickly.

Comparative Analysis: Risk, Returns, and Suitability

When comparing Mombo Sacco Goal Savings Accounts to Forex trading, the primary differences revolve around risk exposure, potential returns, and user involvement.

1. Risk and Stability: Mombo Sacco Goal Savings Accounts stand out as a low-risk option, making them ideal for risk-averse individuals. The returns are stable, ensuring a consistent accumulation of wealth. Conversely, forex trading carries high risks, with rapidly fluctuating currency values potentially leading to substantial gains but also significant financial losses.

2. Potential Returns: Forex trading offers higher potential returns compared to Mombo Sacco Goal Savings Accounts, which cap returns based on predetermined profit rates. While forex can lead to lucrative outcomes, it’s important to note that this high reward potential is accompanied by the risk of losing the entire investment.

3. Time and Involvement: Participating in forex trading typically demands a strong grasp of market dynamics, constant monitoring, and swift decision-making. Forex traders often require substantial time commitment and stress management due to market volatility. In contrast, Mombo Sacco Goal Savings Accounts offer a more passive saving approach where savings grow over time with minimal day-to-day involvement.

4. Regulatory Environment: Mombo Sacco accounts are regulated by the Commissioner of Cooperatives Development, ensuring security and transparency for savers’ funds. Forex trading, on the other hand, relies heavily on broker credibility and is subject to market regulations that may vary across brokers and regions.

Choosing the Right Financial Path

Both Mombo Sacco Goal Savings Accounts and Forex trading offer distinct pathways to financial growth. The choice depends on individual financial objectives, risk tolerance, and level of market engagement.

For those who prefer a predictable and secure environment for saving and achieving specific financial goals, Mombo Sacco accounts provide a structured and rewarding platform. Conversely, for individuals interested in high-risk, high-reward scenarios and with a strong grasp of market trends, forex trading may present an appealing venture to explore potential lucrative returns.

Conclusion

Understanding the differences between Mombo Sacco Goal Savings Accounts and forex trading is crucial for Kenyans as they navigate financial decisions. With each offering its own set of advantages and limitations, choosing the right financial tool requires careful reflection on personal goals, risk appetite, and the resources available for investment management. As the Kenyan financial landscape continues to evolve, being informed about such diverse options ensures that individuals and businesses can strategically optimize their financial portfolios for long-term success.

Enhancing Financial Inclusion: The Role of Mombo Sacco Goal Savings Accounts in Kenya Introduction Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that

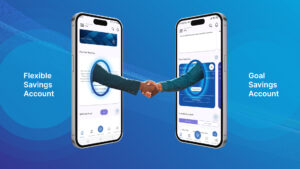

Exploring the Intersection between Mombo Sacco Goal Savings Accounts and Flexible Savings Accounts Introduction Mombo Sacco has established itself as a leader in innovative financial solutions, offering both Goal Savings

Fostering Social Cohesion through Mombo Sacco Goal Savings Accounts Introduction In today’s fast-paced society, financial goals and savings are often seen as individual pursuits. However, Mombo Sacco’s Goal Savings Accounts

Download the Mombo app and follow the simple steps to register in minutes.