Enhancing Financial Inclusion

Enhancing Financial Inclusion: The Role of Mombo Sacco Goal Savings Accounts in Kenya Introduction Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that

Kenya’s youth represent a vibrant and dynamic segment of the population, with unique saving objectives shaped by aspirations for education, entrepreneurship, housing, and financial autonomy. Mombo Sacco Goal Savings Accounts are meticulously designed to resonate with these objectives, providing tailored financial solutions that empower young savers in Kenya. By fostering a proactive saving culture, Mombo Sacco supports the aspirations of the youth, aligning with their goals and contributing to their overall financial well-being.

Flexibility and Accessibility

Mombo Sacco Goal Savings Accounts offer unmatched flexibility, allowing the youth to set personalized saving targets. Whether for education, starting a business, or purchasing a home, these accounts enable young savers to define their specific objectives. The Goal Accounts come with flexible saving periods, such as Sprint and Marathon Goal Accounts, catering to both short-term and long-term ambitions. This versatility aligns seamlessly with the diverse and dynamic nature of youthful goals, making saving more relatable and feasible for young Kenyans.

Attractive Profit Rates

The competitive profit rates associated with Mombo Sacco Goal Accounts are particularly appealing to the youth, who often seek effective ways to grow their savings. By offering higher returns, especially with the Marathon Goal Accounts’ 12% per annum compounding profit rate, Mombo Sacco incentivizes young savers to commit to disciplined saving behaviors. This appeal to financial growth potential aligns perfectly with the youth’s inclination towards maximizing returns on their savings, enabling them to realize their dreams faster.

Emphasis on Financial Literacy

A key component of Mombo Sacco’s offering is its emphasis on financial literacy. The youth in Kenya often face a knowledge gap regarding effective saving strategies and investment opportunities. Mombo Sacco addresses this by providing access to valuable financial literacy resources through its digital platforms. By equipping the youth with knowledge and insights, Mombo Sacco empowers them to make informed financial decisions, align with their savings objectives, and plan for a secure future.

Encouraging Collaborative Saving

Many Kenyan youths belong to social groups, such as Chamas, where collaborative saving and investment are commonplace. Mombo Sacco Goal Savings Accounts accommodate this cultural aspect through shared goals, enabling groups to come together, pool resources, and work towards common financial targets. This feature makes the saving process more engaging and relatable to Kenyan youth, fostering a sense of community while encouraging responsible financial planning.

Technology Integration

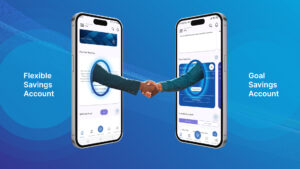

Technology is a crucial element in the lives of Kenyan youth, who are increasingly inclined towards digital solutions. Mombo Sacco integrates technology through its user-friendly mobile app, offering seamless management of savings accounts. This digital approach aligns with the tech-savvy nature of the youth, making it easier for them to track progress, manage funds, and stay on top of their savings goals right at their fingertips.

Conclusion

Mombo Sacco Goal Savings Accounts are strategically aligned with the saving objectives of Kenyan youth. By offering flexibility, competitive returns, financial literacy resources, and a digital-first approach, Mombo Sacco meets the unique aspirations and needs of young savers. As the youth continue to pursue diverse financial goals, Mombo Sacco stands as a trusted partner, facilitating their journey towards financial independence and success in dynamic and innovative ways. Through this alignment, Mombo Sacco not only supports the aspirations of the youth but also contributes to the broader economic development of Kenya by empowering a generation that holds the potential to drive significant positive change.

Enhancing Financial Inclusion: The Role of Mombo Sacco Goal Savings Accounts in Kenya Introduction Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that

Exploring the Intersection between Mombo Sacco Goal Savings Accounts and Flexible Savings Accounts Introduction Mombo Sacco has established itself as a leader in innovative financial solutions, offering both Goal Savings

Fostering Social Cohesion through Mombo Sacco Goal Savings Accounts Introduction In today’s fast-paced society, financial goals and savings are often seen as individual pursuits. However, Mombo Sacco’s Goal Savings Accounts

Download the Mombo app and follow the simple steps to register in minutes.