Maximizing Financial Growth

Maximizing Financial Growth: The Synergy of Mombo Sacco Goal Savings Accounts and MWallet in Kenya In today’s rapidly evolving financial landscape, Kenyans are constantly seeking innovative solutions to bolster their

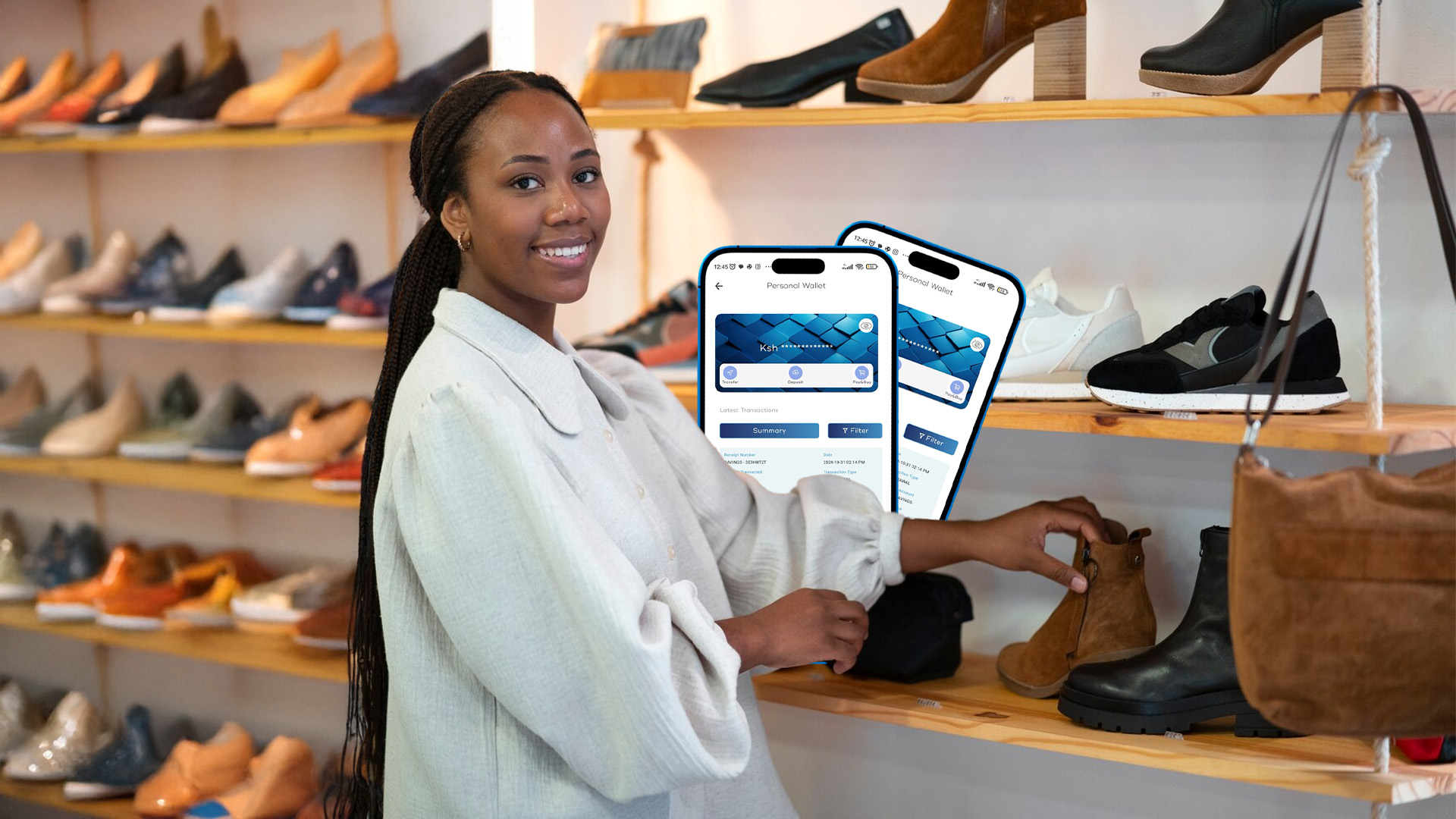

In the vibrant and ever-expanding business landscape of Kenya, Small and Medium Enterprises (SMEs) have become the backbone of economic growth. The ability to manage financial processes effectively is vital for the survival and success of any business, especially SMEs. This is where Mombo Sacco MWallet comes into play. Designed specifically for entrepreneurs, Mombo Sacco MWallet offers a seamless, secure, and cost-effective solution to optimize payment systems, manage cash flow, and enhance savings. Whether you’re a vendor or a business owner, Mombo Sacco MWallet can be the key to unlocking your SME’s growth potential.

In the fast-paced world of business, time is money. Mombo Sacco MWallet significantly simplifies the payment process for business owners in Kenya. Gone are the days of waiting for long periods to receive payments or struggling to pay suppliers on time.

Mombo Sacco MWallet seamlessly integrates with both traditional bank accounts and mobile money platforms like M-Pesa. This flexibility ensures fast, hassle-free transactions, no matter where you or your customers are located in Kenya. With a user-friendly interface, business owners can quickly send and receive payments, saving valuable time that could be better spent focusing on growth.

Reducing operational costs is critical to growing any business. One of the most significant expenses for many SMEs is transaction fees, which can add up quickly over time. Mombo Sacco MWallet offers substantial savings on transaction costs.

With Mombo Sacco MWallet, business owners can save up to 50% on transaction fees compared to traditional banking systems and other mobile payment solutions. These savings can then be reinvested back into the business, whether for inventory, marketing, or expanding your team. This feature alone can significantly impact your bottom line, making it an invaluable tool for SMEs aiming to scale.

Effective cash flow management is crucial for any successful enterprise. Without it, a business can quickly run into financial difficulties. Mombo Sacco MWallet offers powerful tools to manage cash flow efficiently.

The MWallet comes equipped with tools that allow business owners to automate savings, schedule payments, and even plan for future expenses. By integrating budgeting features into the wallet, you can better track inflows and outflows, ensuring your business stays financially healthy. Whether you’re paying suppliers or saving for future investments, the Mombo Sacco MWallet gives you control over your finances.

In today’s digital world, security is a top concern for businesses. With Mombo Sacco MWallet, security and transparency are paramount.

The Mombo Sacco MWallet ensures your business’s financial transactions are secure with encryption and robust security protocols. Additionally, the platform offers full transparency in every transaction, providing you with peace of mind that your financial data is safe from fraud. Real-time notifications and transaction alerts ensure you’re always up to date on your business’s financial activities.

When you join Mombo Sacco, you gain more than just access to a digital wallet—you become part of a vibrant community of entrepreneurs and business professionals across Kenya.

By connecting with the M-Community, you can forge valuable partnerships, find loan guarantors, and tap into a wealth of expertise. This network is designed to support your business’s growth, providing mentorship opportunities, collaborations, and connections that may have otherwise been out of reach. Networking within the Mombo Sacco MWallet ecosystem enhances your SME’s potential and opens doors to new opportunities.

As your business grows, your financial needs will evolve. Whether you are a sole proprietor or managing a team, Mombo Sacco MWallet offers flexible financial solutions tailored to meet your needs.

For growing businesses, having multi-tier transaction approvals can be crucial. Mombo Sacco MWallet allows for bulk payment processing and approval workflows, making it easier to manage team finances. Whether it’s for employee payroll or supplier payments, the flexibility of Mombo Sacco MWallet helps you scale your financial operations smoothly.

There are times when unexpected expenses or opportunities arise, and having access to extra funds can make all the difference. With Mombo Sacco MWallet, you can access additional funds instantly.

The overdraft feature offered by Mombo Sacco MWallet gives business owners the financial flexibility they need to stay agile. Whether you need extra funds for inventory or to cover an unexpected expense, you can access cash quickly to keep your business running smoothly. This feature provides peace of mind knowing that you can maintain operations even during financial setbacks.

For Kenyan SMEs, embracing the digital edge with Mombo Sacco MWallet means streamlined payment processes, reduced costs, and enhanced financial management. By integrating this digital wallet into your business operations, you are not only improving the efficiency of your financial transactions but also setting your business on the path to sustained growth and prosperity.

Choose Mombo Sacco MWallet to optimize your business’s financial systems today, and give your SME the tools it needs to thrive in Kenya’s dynamic market landscape.

1. How does Mombo Sacco MWallet help businesses save on transaction fees?

By reducing transaction fees by up to 50%, Mombo Sacco MWallet allows businesses to save significantly on operational costs, enabling reinvestment into the business.

2. Is it safe to use Mombo Sacco MWallet for business transactions?

Yes, Mombo Sacco MWallet employs advanced encryption and multi-layered security protocols to ensure your transactions are secure.

3. Can I integrate Mombo Sacco MWallet with my existing payment systems?

Absolutely! MWallet integrates seamlessly with both bank accounts and M-Pesa, making it easy to manage all your payments in one place.

Maximizing Financial Growth: The Synergy of Mombo Sacco Goal Savings Accounts and MWallet in Kenya In today’s rapidly evolving financial landscape, Kenyans are constantly seeking innovative solutions to bolster their

Navigating Financial Waters: A Comparative Analysis of Mombo Sacco Goal Savings Accounts and Money Market Funds in Kenya In the quest for financial growth and stability, Kenyans are often presented

Navigating the Financial Landscape: Comparing Mombo Sacco Goal Savings Accounts and Insurance Education Plans in Kenya When individuals and families in Kenya seek to save for education-related expenses, they often

Download the Mombo app and follow the simple steps to register in minutes.