Introduction

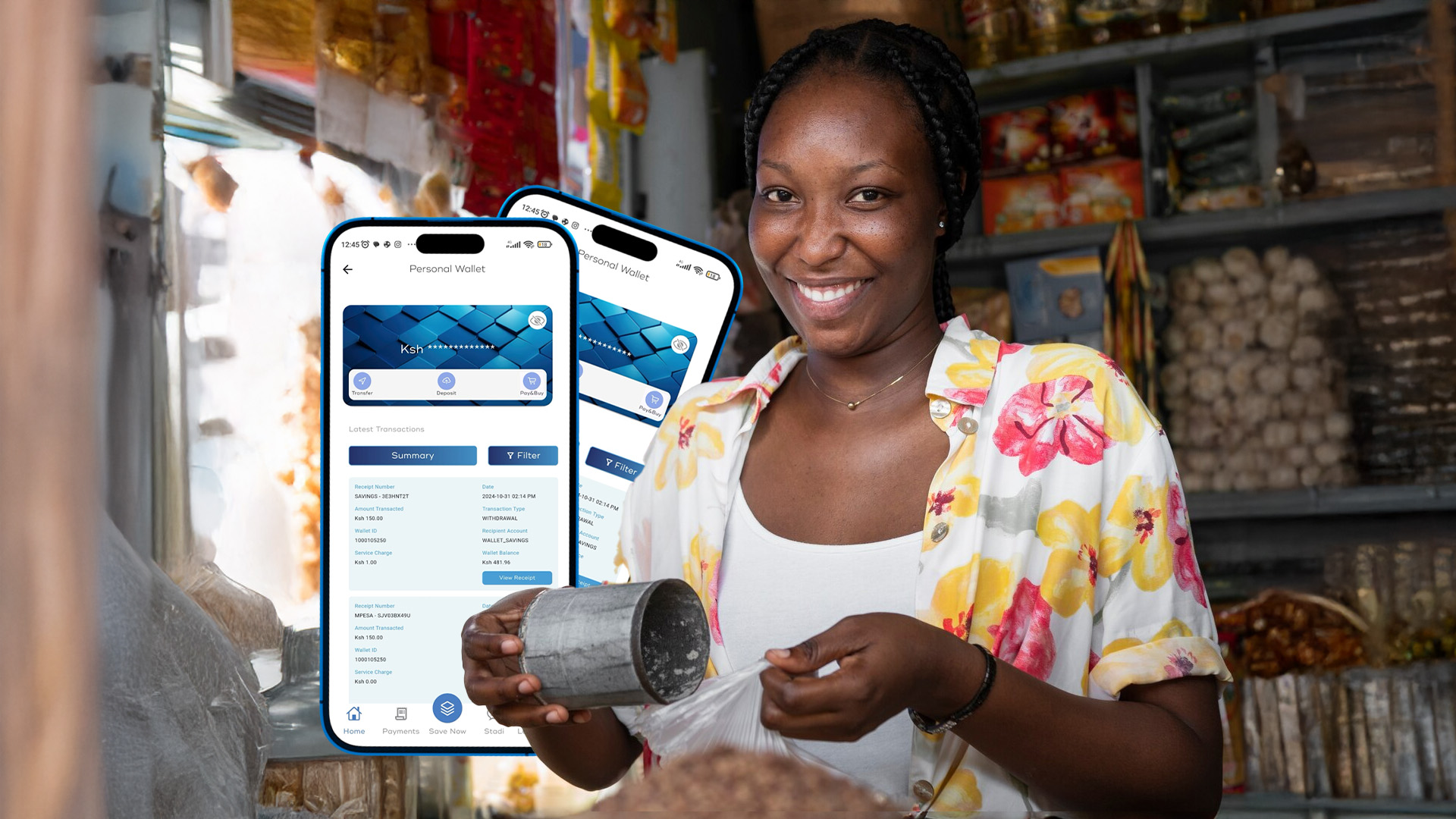

For small businesses in Kenya with less than 20 employees, efficient financial management is vital for success. Discover how the Mombo Sacco MWallet can streamline your operations, boost efficiency, and drive growth. Learn why this digital wallet is the best choice for small businesses seeking agility and financial control.

1. Efficient Salary and Payment Solutions

Handling payroll can be challenging. Mombo Sacco MWallet provides a seamless and secure way to process employee salaries and payments, letting you focus on your core business activities. Discover how this cost-effective solution saves you time and enhances efficiency.

2. Cost-Effective Financial Management

Reduce transaction costs by up to 50% with Mombo Sacco MWallet. These savings mean more money for business growth and development, from expanding operations to investing in new infrastructure. Find out how you can maximize profits and reinvest savings strategically.

3. Increased Financial Transparency

Build trust with your employees and stakeholders by maintaining transparency in transactions. Mombo Sacco MWallet offers a comprehensive transaction history and real-time alerts, ensuring accountability and reducing discrepancies.

4. Secure Transactions for Peace of Mind

Protect your financial data with advanced security features of Mombo Sacco MWallet. Ensure safe transactions for your business, safeguarding it from potential fraud or breaches. Learn how this trusted platform keeps your business’s financial integrity intact.

5. Flexible Financial Management

Adapt to your business’s changing needs with the flexible features of Mombo Sacco MWallet. Easily manage and schedule payments while scaling operations efficiently. Discover how this solution can grow alongside your business.

6. Smart Budgeting and Planning Tools

Utilize Mombo Sacco MWallet’s integrated budgeting and planning tools for effective financial management. Monitor expenses and manage budgets to make informed decisions. Uncover the benefits of these features in keeping your business on the path to growth.

7. Boost Employee Satisfaction

Ensure timely salary payments and boost employee morale using Mombo Sacco MWallet. A motivated workforce contributes to a thriving business. Learn how effective payment processing can enhance trust and stability within your team.

8. Connect with the M-Community Network

Join the supportive Mombo Sacco network and connect with fellow entrepreneurs. Exchange insights, share experiences, and collaborate for enhanced business operations. Learn how being part of this community can drive success for your small business.

Conclusion: Elevate Your Business with Mombo Sacco MWallet

Mombo Sacco MWallet offers Kenyan small businesses a comprehensive solution for efficient financial management. With features that enhance transparency, security, and flexibility, it’s your business’s perfect partner for achieving growth and success.

Harness the power of Mombo Sacco MWallet to streamline operations and unlock new possibilities. Equip your business for prosperity in Kenya’s dynamic market with the innovative solutions provided by Mombo Sacco MWallet. Make the choice today and set your business on a path to a brighter future.

FAQs:

1. Can Mombo Sacco MWallet grow with my business?

Absolutely! Mombo Sacco MWallet is flexible and scalable, allowing it to grow alongside your business. Whether you need to manage more employees, handle larger transactions, or adapt to new financial demands, the platform provides the tools and resources necessary to support your business’s evolving needs.

2. Is Mombo Sacco MWallet secure for conducting business transactions?

Yes, Mombo Sacco MWallet is designed with advanced security features, including encryption and secure authentication methods. These measures ensure that all financial data and transactions are protected, safeguarding your business from fraud or data breaches.

3. What are the cost-saving benefits of using Mombo Sacco MWallet?

By using Mombo Sacco MWallet, small businesses can reduce transaction costs by up to 50%. This is achieved by eliminating the fees associated with traditional banking services, such as wire transfers or cash withdrawals. These savings can then be reinvested into business expansion or used for other development purposes.