Enhancing Financial Inclusion

Enhancing Financial Inclusion: The Role of Mombo Sacco Goal Savings Accounts in Kenya Introduction Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that

Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that individuals and communities have access to affordable financial products and services. Mombo Sacco Goal Savings Accounts play a pivotal role in deepening financial inclusion by providing accessible and tailored financial tools encouraging saving and economic participation among Kenyans.

Bridging the Financial Access Gap

Mombo Sacco Goal Savings Accounts are designed to bring financial services closer to individuals and communities traditionally underserved by formal banking institutions. By offering both personal and shared savings accounts, Mombo Sacco provides flexible options for individuals and groups to save towards specific goals, such as education, healthcare, or asset acquisition. This ability to personalize savings plans makes financial services more attractive and accessible, thereby reaching a wider demographic.

Promoting a Culture of Savings

A significant barrier to financial inclusion is the lack of a savings culture in many regions. Mombo Sacco Goal Savings Accounts address this by offering competitive interest rates, with Sprint Goal Accounts providing a 6% per annum return and Marathon Goal Accounts offering a 12% per annum return. These attractive rates incentivize individuals to start saving, making it easier for them to secure their financial futures. The structured savings approach fosters a disciplined financial habit, which is crucial for enhancing financial literacy and long-term financial independence.

Empowering Underserved Groups

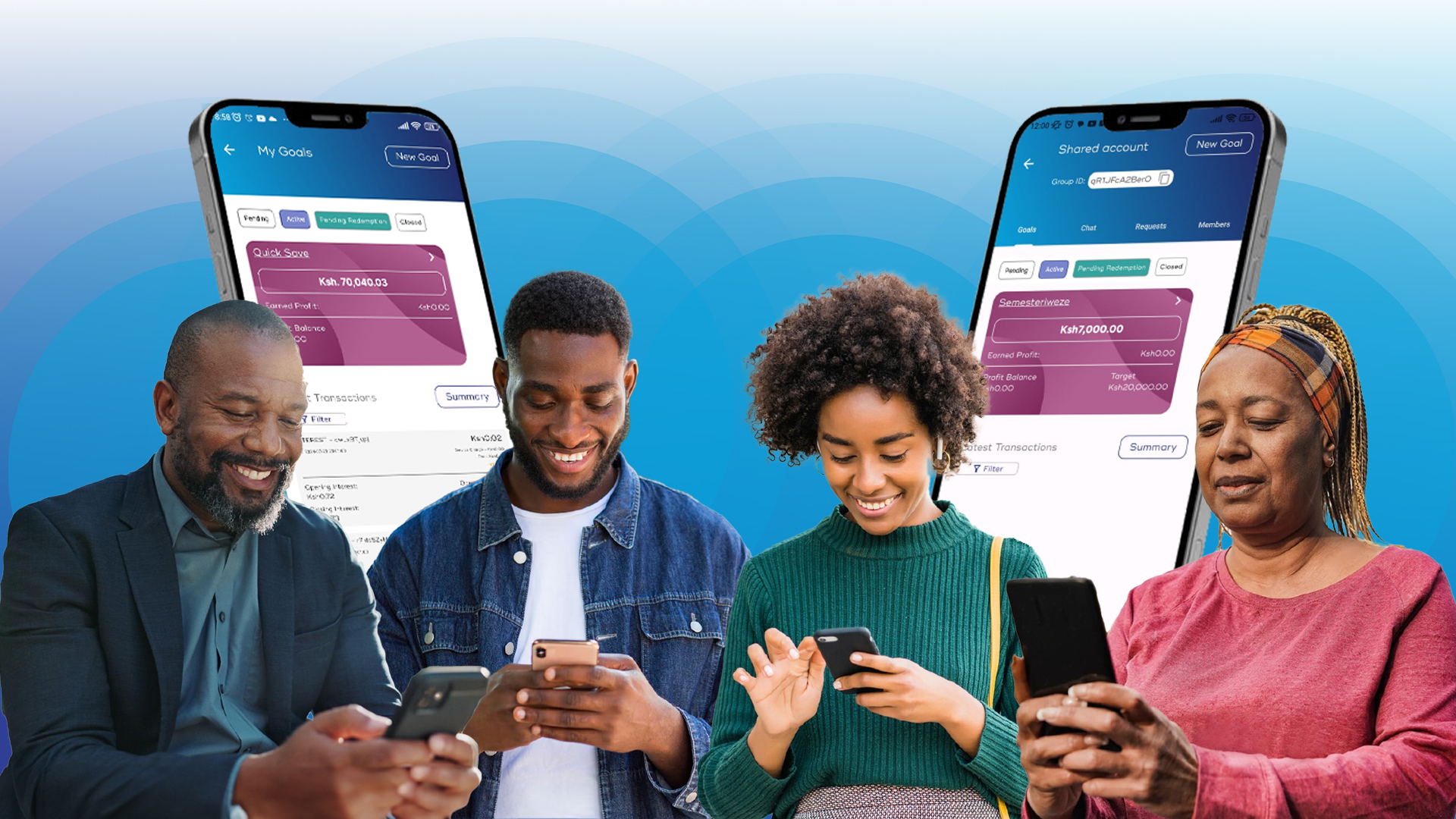

Mombo Sacco recognizes the needs of various societal groups, including women, youth, and low-income earners, who often face barriers in accessing traditional financial services. The Mombo App allows users to manage and customize their savings plans independently, breaking down geographical and economic barriers that previously restricted financial access. This empowerment through technology ensures that even the most marginalized groups can partake in economic activities traditionally beyond their reach.

Supporting Community-Based Savings

The shared goal feature within Mombo Sacco Goal Savings Accounts encourages community-based savings, allowing friends or family members to work collectively towards common financial objectives. This communal approach enhances trust and cooperation within communities and aligns well with Kenya’s socio-cultural framework, which often emphasizes collective progress and responsibility. Community-based savings play a crucial role in reducing economic disparities and building a more inclusive financial ecosystem.

Enhancing Financial Literacy and Awareness

Financial literacy is a key component of financial inclusion. Through Mombo Sacco’s app, users access valuable financial education resources. By providing insights and guidance, these resources empower Kenyans to make informed financial decisions, enhancing their understanding of savings, investments, and financial planning. Improved financial literacy helps individuals take advantage of financial opportunities that can lead to economic upliftment, further promoting inclusive growth.

Conclusion

Mombo Sacco Goal Savings Accounts are a catalyst for deepening financial inclusion in Kenya. By offering flexible, attractive, and accessible savings solutions, Mombo Sacco is bridging the financial access gap, promoting a culture of savings, and empowering underserved groups to engage more fully in the financial system. The emphasis on community-based savings, coupled with enhanced financial literacy tools, ensures that more Kenyans can participate in economic growth and secure their financial futures.

Mombo Sacco’s innovative approach to savings not only aligns with national goals for financial inclusion but also demonstrates a successful model for other regions seeking to enhance economic participation among underrepresented populations. Through these efforts, Mombo Sacco continues to contribute significantly to a more financially inclusive Kenya, paving the way for sustainable economic growth and development.

Enhancing Financial Inclusion: The Role of Mombo Sacco Goal Savings Accounts in Kenya Introduction Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that

Exploring the Intersection between Mombo Sacco Goal Savings Accounts and Flexible Savings Accounts Introduction Mombo Sacco has established itself as a leader in innovative financial solutions, offering both Goal Savings

Fostering Social Cohesion through Mombo Sacco Goal Savings Accounts Introduction In today’s fast-paced society, financial goals and savings are often seen as individual pursuits. However, Mombo Sacco’s Goal Savings Accounts

Download the Mombo app and follow the simple steps to register in minutes.