Enhancing Financial Inclusion

Enhancing Financial Inclusion: The Role of Mombo Sacco Goal Savings Accounts in Kenya Introduction Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that

In Kenya’s vibrant social culture, managing shared expenses can often be a daunting task. Whether it’s a joyous family gathering, festive celebration, or a collaborative project, coordinating financial contributions can sometimes cast a shadow on the occasion’s joy. Enter the Mombo Sacco MWallet’s split bills feature – a revolutionary tool that transforms how Kenyans handle group financial commitments. Discover why this feature is quickly becoming an indispensable part of social and financial planning in Kenya.

Effortless Group Contributions Management

Kenyan social events, from weddings to holidays, thrive on the spirit of togetherness. However, managing shared expenses can become cumbersome when dealing with various financial capabilities among participants. The Mombo Sacco MWallet’s split bills feature simplifies this by dividing expenses evenly and transparently. Each participant knows their share in advance, ensuring smooth transactions and fostering harmony within the group.

Enhancing Financial Transparency and Trust

Transparency is key to maintaining trust in any financial arrangement. The MWallet provides detailed records of expenses, showcasing how costs are shared and confirming who has completed their payments. This clarity eliminates misunderstandings, prevents disputes, and builds trust among friends and family. Enjoy a stress-free environment where financial dealings are handled with clarity and integrity.

Facilitating Collaborative Financial Planning

Planning joint ventures like vacations, business investments, or community projects is effortless with the MWallet’s split bills feature. It facilitates collaborative budgeting and saving, allowing members to have clear insights into expected expenses. This foresight enhances collective decision-making, uniting groups under a common financial goal with clarity and coordination.

Adapting to Kenya’s Diverse Social Scenes

Kenya’s rich cultural diversity means that social events are varied and plentiful. The MWallet’s split bills feature is versatile, adapting seamlessly to all social scenarios, whether you’re planning a family reunion or a community event. This adaptability ensures you can immerse yourself in these experiences, free from financial concerns and complications.

Maximizing Convenience and Saving Time

Financial logistics can detract from the joy of shared experiences. The MWallet eliminates the tediousness of calculating and collecting individual contributions, ensuring quick, efficient settlements. Spend less time worrying about finances and more time cherishing moments with loved ones, thanks to this user-friendly tool.

Promoting Financial Responsibility and Discipline

Utilizing the split bills feature in group settings cultivates financial discipline. By understanding their obligations in advance, participants are encouraged to manage their finances responsibly, fostering a culture of financial literacy and reliability within communities.

Strengthening Community Connections

Beyond financial transactions, the MWallet enhances community bonds by simplifying how shared expenses are managed. This ease of use builds camaraderie, support, and deeper connections among Kenyan social circles, ensuring that the richness of relationships is maintained beyond financial dealings.

Conclusion: Embrace Financial Harmony with Mombo Sacco MWallet

The Mombo Sacco MWallet’s split bills feature is more than just a financial tool—it’s a pathway to harmonious financial interactions. Kenyans looking to enrich their social experiences will find this feature crucial. Offering efficiency, transparency, and convenience, the MWallet allows friends and family to focus on what truly matters: celebrating life together. Elevate your group financial management today with the Mombo Sacco MWallet split bills feature and transform your approach to shared finances. Embrace innovation, and let your social gatherings thrive without financial friction.

Enhancing Financial Inclusion: The Role of Mombo Sacco Goal Savings Accounts in Kenya Introduction Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that

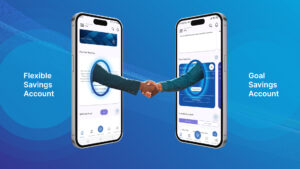

Exploring the Intersection between Mombo Sacco Goal Savings Accounts and Flexible Savings Accounts Introduction Mombo Sacco has established itself as a leader in innovative financial solutions, offering both Goal Savings

Fostering Social Cohesion through Mombo Sacco Goal Savings Accounts Introduction In today’s fast-paced society, financial goals and savings are often seen as individual pursuits. However, Mombo Sacco’s Goal Savings Accounts

Download the Mombo app and follow the simple steps to register in minutes.