Enhancing Financial Inclusion

Enhancing Financial Inclusion: The Role of Mombo Sacco Goal Savings Accounts in Kenya Introduction Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that

The traditional Sacco industry has long been a cornerstone of Kenya’s financial landscape. With the rise of digital technology, there’s a clear need for modernization to keep up with the demands of today’s tech-savvy population. Enter the Mombo Sacco MWallet—a revolutionary solution that is redefining how Kenyans engage with their savings and credit cooperative societies.

Digitization: Merging Tradition with Modern Innovation

For years, traditional Saccos have relied on manual processes and face-to-face interactions, resulting in inefficiencies and limited reach. The Mombo Sacco MWallet changes this narrative by embracing digital transformation. With this user-friendly app, members can effortlessly manage accounts, make deposits, access loans, and conduct transactions. This digital shift not only broadens reach but also eliminates geographical barriers, making Sacco benefits accessible to all Kenyans.

Enhancing User Experience and Accessibility

At its core, the Mombo Sacco MWallet prioritizes user experience. This mobile-first approach aligns with Kenya’s tech-savvy generation, offering round-the-clock financial access. By eliminating the dependency on physical branches, members gain financial freedom and control—anytime and anywhere.

Innovative Financial Solutions for Diverse Needs

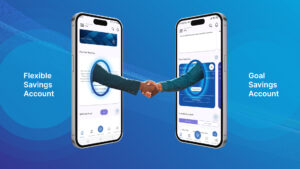

Mombo Sacco MWallet offers a range of financial products tailored to individual needs, from competitive savings accounts to flexible loan options and SME-focused products. By providing accessible credit, MWallet supports grassroots economic development, promoting widespread financial inclusion.

Secure and Transparent Transactions: Building Trust

Security and transparency are key tenets of Mombo Sacco MWallet. The app employs robust security measures to safeguard user data and financial assets. Real-time alerts and detailed account statements ensure complete transparency, reinforcing user trust in managing financial transactions.

Promoting Financial Literacy and Inclusion

Mombo Sacco MWallet goes beyond providing financial services by integrating educational resources directly into the platform. This empowers members to make informed financial decisions, enhancing their financial well-being. By fostering financial literacy, MWallet contributes to a more informed and capable society, paving the way for Kenya’s economic growth.

Conclusion: Leading the Future of Kenyan Saccos

The Mombo Sacco MWallet is at the forefront of transforming Kenya’s traditional Sacco industry. It champions digital innovation, enhances accessibility, offers tailored financial products, and promotes financial literacy. As the MWallet continues to grow, it establishes itself as a leader in the modern cooperative financial landscape, ensuring that Saccos remains relevant and impactful in Kenya’s evolving digital era.

Enhancing Financial Inclusion: The Role of Mombo Sacco Goal Savings Accounts in Kenya Introduction Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that

Exploring the Intersection between Mombo Sacco Goal Savings Accounts and Flexible Savings Accounts Introduction Mombo Sacco has established itself as a leader in innovative financial solutions, offering both Goal Savings

Fostering Social Cohesion through Mombo Sacco Goal Savings Accounts Introduction In today’s fast-paced society, financial goals and savings are often seen as individual pursuits. However, Mombo Sacco’s Goal Savings Accounts

Download the Mombo app and follow the simple steps to register in minutes.