What is Chama?

Chama is a Swahili word that means “group” or “association.” In the context of the Mombo app, Chama refers to a savings and investment group of up to 100 individuals who come together to pool their resources and invest in various financial instruments such as stocks, bonds, and mutual funds.

M-Chama is a product for small community groups (chamas) recognised in law as self-help groups. The chamas can have an already existing membership or completely new.

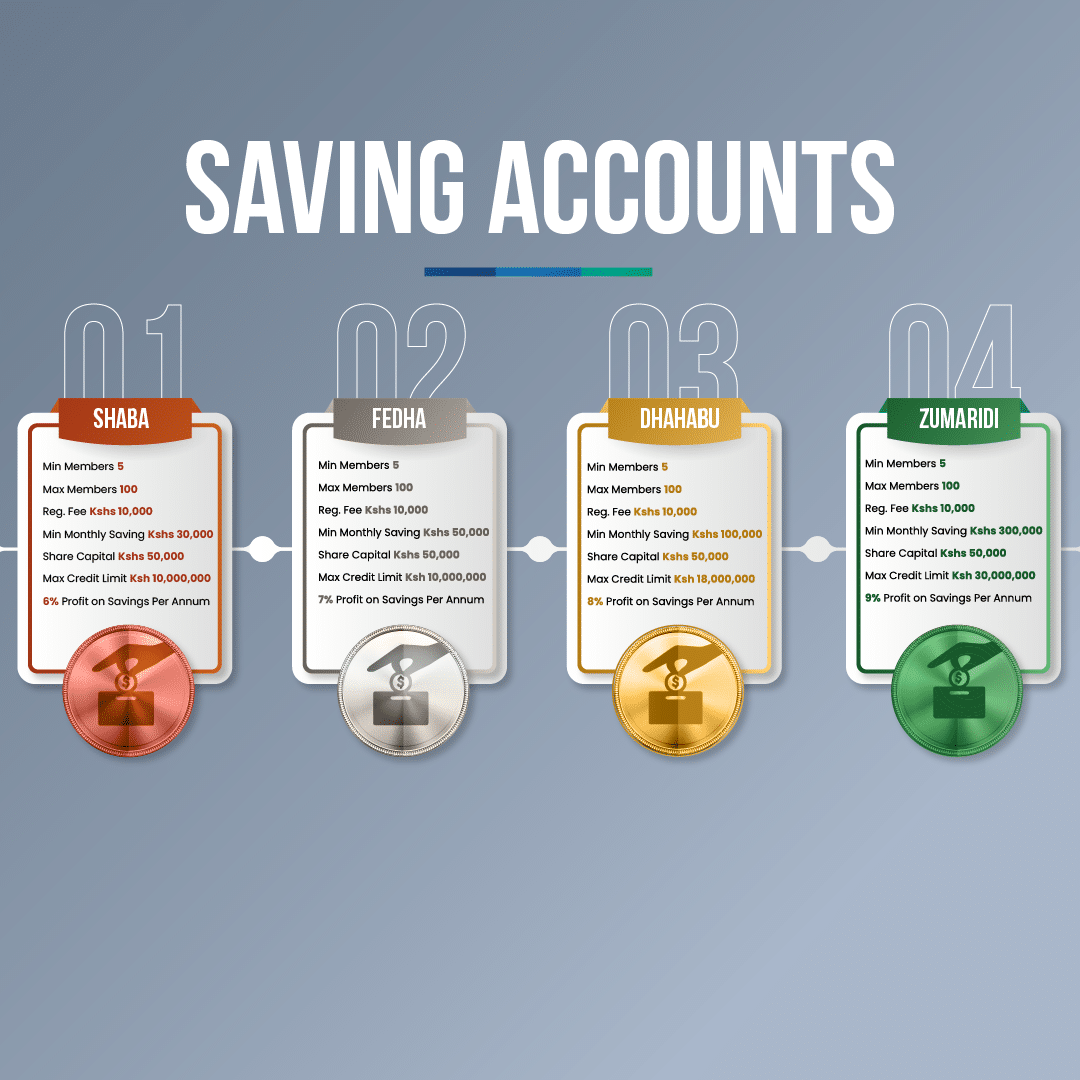

About Our Mchama Plans

- Shaba Saving Account

Minimum members is five (5) and maximum members is hundred (100); Registration fee is Ksh 10,000; minimum monthly saving is Ksh 30,000; Share capital is Ksh 50,000 paid before starting to save.

Maximum deposit top up to access credit immediately is Ksh 100,000. The maximum credit limit is Ksh 10,000,000. Profit on savings is 6% per annum accrued monthly and withdrawn once a year in January. Identify a Chama savings plan from the Chama profiles.

2. Fedha Saving Account

Minimum members is five (5) and maximum members is hundred (100); Registration fee is Ksh 10,000; minimum monthly saving is Ksh 50,000; Share capital is Ksh 50,000 paid before starting to save.

Maximum deposit top up to access credit immediately is Ksh 100,000, the maximum credit limit is Ksh 10,000,000. Profit on savings is 7% per annum accrued monthly and withdrawn once a year in January. Identify a Chama savings plan from the Chama profiles.

3. Dhahabu Saving Account

Minimum members is five (5) and maximum members is hundred (100); Registration fee is Ksh 10,000; minimum monthly saving is Ksh 100,000; Share capital is Ksh 50,000 paid before starting to save.

Maximum deposit top up to access credit immediately is Ksh 200,000, the maximum credit limit is Ksh 18,000,000. Profit on savings is 8% per annum accrued monthly and withdrawn once a year in January. Identify a Chama savings plan from the Chama profiles.

4. Zumaridi Saving Account

Minimum members is five (5) and maximum members is hundred (100); Registration fee is Ksh 10,000; minimum monthly saving is Ksh 300,000; Share capital is Ksh 50,000 paid before starting to save.

Maximum deposit top up to access credit immediately is Ksh 600,000, the maximum credit limit is Ksh 30,000,000. Profit on savings is 9% per annum accrued monthly and withdrawn once a year in January. Identify a Chama savings plan from the Chama profiles.

Onboarding Process

A Mombo App user whether a member or non-member can create a Chama from the App by tapping on marketplace then M-Chama on the pop-up. From here tap on on Create and enter the Chama name, select the saving plan and submit.

Based on the saving plan selected approval shall be automatic and the next step shall be payment of registration fee. Registration fee can be partly or whole some and a Chama ID shall be generated once the full amount is paid. Once a Chama is created and reg fee is fully paid the Chama shall be listed under the Join Chama menu.

The creator shall submit a request to join and will be approved automatically. All subsequest users join requests shall be approved by a majority of each Chama 3 officials – Chair, Secretary and Tresaurer. Each Chama will display some details to the public to enable users select most appropriate Chama. Once selected a user shall be expected to select his Occupation and explain why they want to join that Chama and submit.

Once a join request is submitted, all officials in that chama will be notified of the request via email and directed to login to the app to vote on the join request by tapping on Membership requests button on homepage of the Chama. From there can can either vote to Approve, Decline or Abstain.

A majority decision within 1 hour of receipt of the join request shall carry the day and an email shall be sent to the applicant.

Payment Channels

Chamas shall have the following payment channel options – M-Pesa, Bank Transfer and Bank Cash Deposit. M-Pesa payments paybill shall be 997585 and Account number is Chama ID where all Chama ID must start with a prefix MCH.

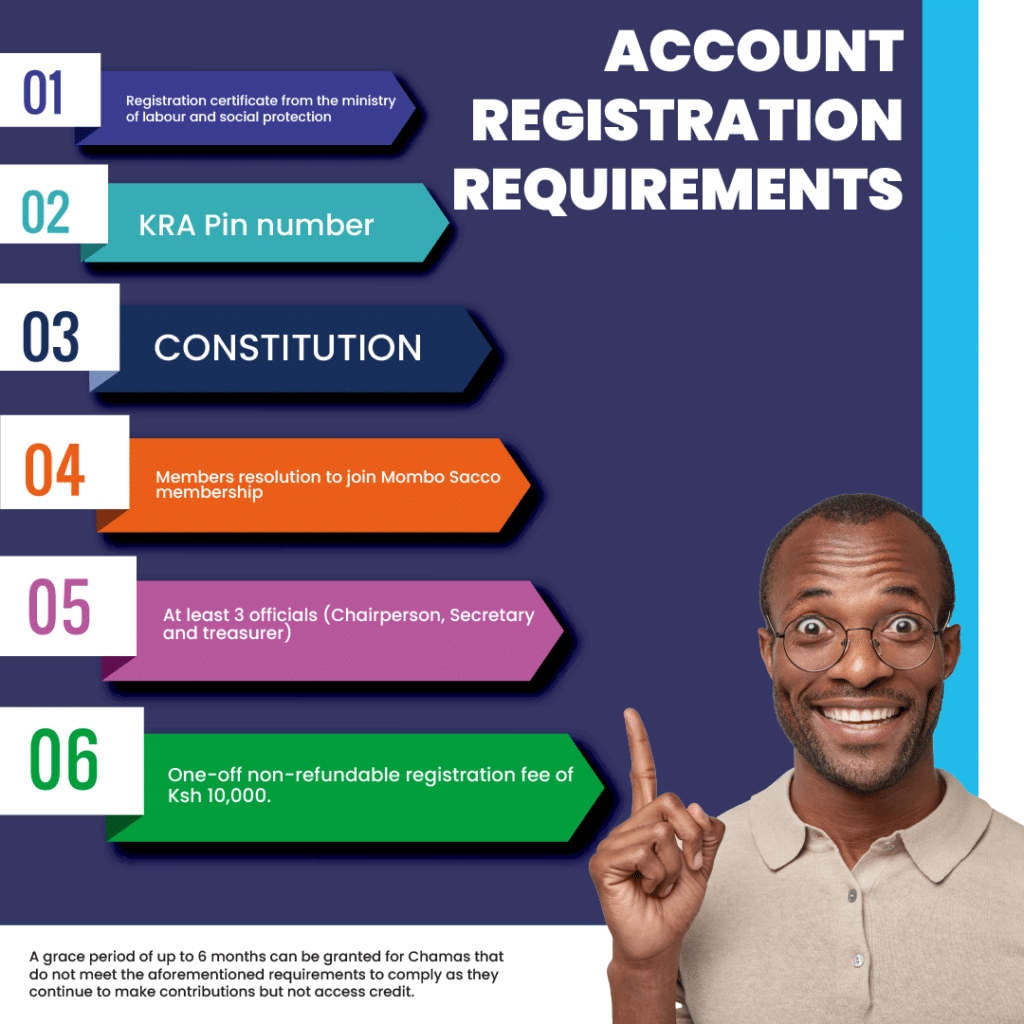

Registration documents such as Registration certificate, KRA pin certificate, Chama Officials national identity cards, Chama Constitution, Members resolution to open an account with Mombo Sacco shall be uploaded to the Chama profiles by Back office users.

What are the benefits of using Mchama?

The Chama feature on the Mombo app offers numerous benefits to individuals who use it. Here are some of the key advantages:

- Collective saving and investing: By pooling their resources, Chama members can achieve more significant savings and invest in more significant financial instruments than they would be able to on their own.

- Financial empowerment: Chama provides individuals with a platform to learn about investing and financial management, empowering them to take control of their financial futures.

- Access to financial expertise: The Mombo app provides access to financial advisors and other financial professionals who can offer guidance and advice to Chama members.

- Reduced risk: By investing in a group, Chama members can spread their risk across multiple investments, reducing their exposure to any single financial instrument.

- Social support: Chama members can provide each other with emotional and social support, creating a sense of community and shared responsibility.