Enhancing Financial Inclusion

Enhancing Financial Inclusion: The Role of Mombo Sacco Goal Savings Accounts in Kenya Introduction Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that

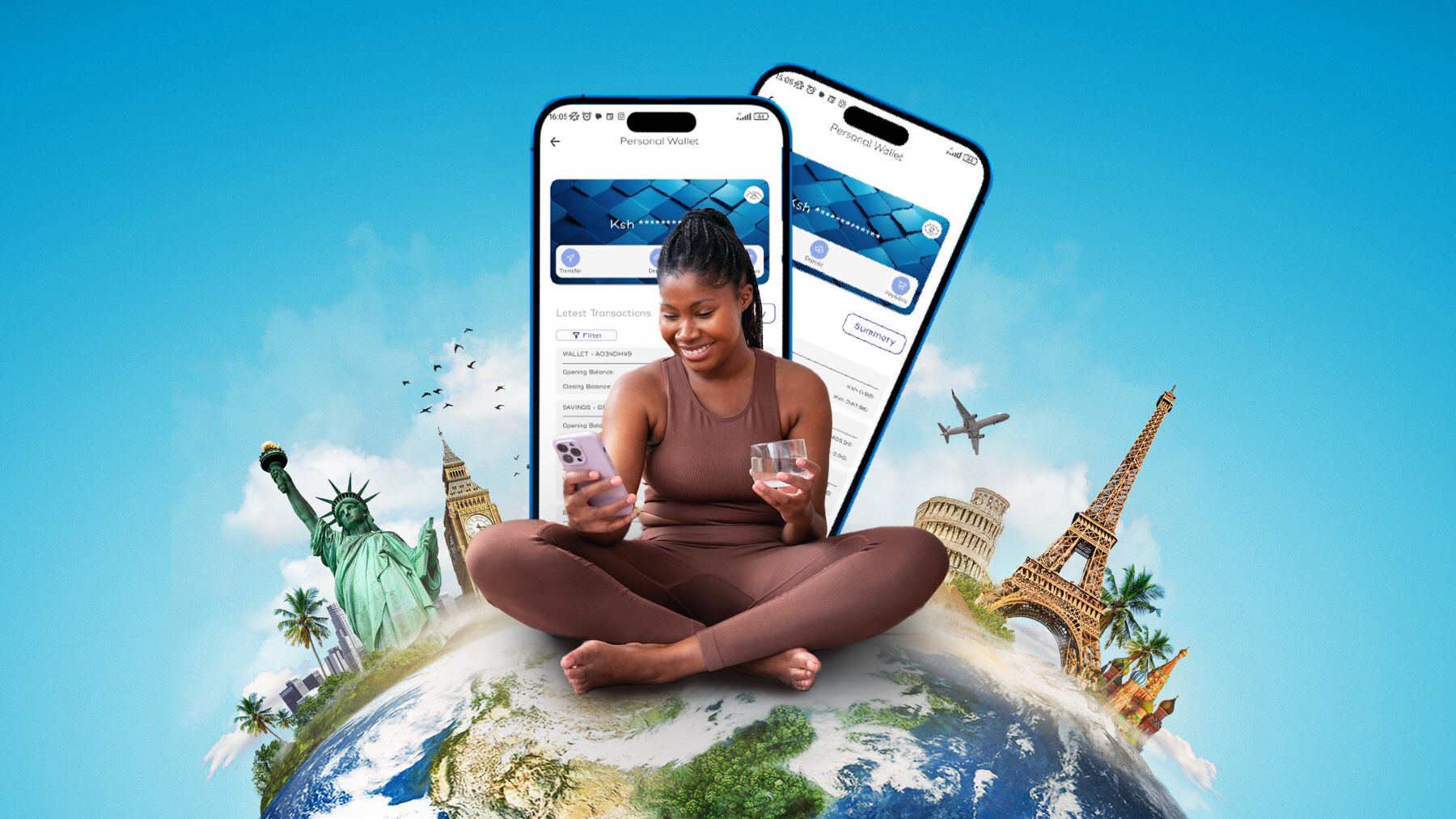

Navigating financial connections to Kenya while living abroad can be a complex task. Whether you’re supporting family, investing locally, or planning your return, having a reliable and versatile financial tool is essential. Discover the benefits of Mombo Sacco MWallet—the perfect digital financial solution for Kenyans in the Diaspora looking to maintain strong financial ties to Kenya, all from the comfort of your current location.

1. Seamless Global Access to Your Kenyan Finances

Mombo Sacco MWallet provides a user-friendly digital platform that empowers you to manage your Kenyan finances from anywhere in the world. With 24/7 access, you can perform seamless financial transactions effortlessly, ensuring constant connectivity to your financial commitments and opportunities back home in Kenya.

2. Effortlessly Support Your Family in Kenya

Supporting family members in Kenya has never been easier. With Mombo Sacco MWallet, instant fund transfers allow you to provide timely assistance to your loved ones, ensuring their needs are met without delay. Enjoy real-time notifications that keep you informed about every transaction, maintaining transparency and trust with your family.

3. Invest in Kenya’s Growing Economy

Mombo Sacco MWallet is the perfect tool for Diaspora Kenyans looking to invest in local businesses or property. With flexible access to financial statements and insights, you can make informed investment decisions, contributing to Kenya’s economic growth while strengthening your financial portfolio.

4. Efficiently Manage Kenyan Expenses from Abroad

Whether it’s property maintenance or other local expenses, Mombo Sacco MWallet simplifies bill payments. From utilities to school fees, manage all your obligations efficiently from one platform, ensuring your financial responsibilities in Kenya are handled smoothly.

5. Secure and Transparent Financial Transactions

Security is a top priority with Mombo Sacco MWallet, safeguarding your financial transactions and personal information. Enjoy peace of mind knowing your financial activities are protected, allowing you to focus on building your dreams, both abroad and in Kenya.

6. Connect with the Kenyan Community

Stay connected to the Kenyan community through Mombo Sacco’s M-Community, offering networking opportunities and potential guarantor connections. This unique system supports Diaspora Kenyans in maintaining and enhancing their social and financial networks back home.

Conclusion: Strengthen Your Kenyan Financial Connections with Mombo Sacco MWallet

For Kenyans living in the Diaspora, Mombo Sacco MWallet offers an all-encompassing solution to maintain and enhance financial ties to your homeland. Experience the convenience, security, and flexibility that empowers you to support family, manage investments, and stay connected with Kenya’s growing economy. Choose Mombo Sacco MWallet today and transform distance into a bridge, ensuring your financial journey remains strong and resilient.

Enhancing Financial Inclusion: The Role of Mombo Sacco Goal Savings Accounts in Kenya Introduction Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that

Exploring the Intersection between Mombo Sacco Goal Savings Accounts and Flexible Savings Accounts Introduction Mombo Sacco has established itself as a leader in innovative financial solutions, offering both Goal Savings

Fostering Social Cohesion through Mombo Sacco Goal Savings Accounts Introduction In today’s fast-paced society, financial goals and savings are often seen as individual pursuits. However, Mombo Sacco’s Goal Savings Accounts

Download the Mombo app and follow the simple steps to register in minutes.