Enhancing Financial Inclusion

Enhancing Financial Inclusion: The Role of Mombo Sacco Goal Savings Accounts in Kenya Introduction Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that

Managing finances effectively is crucial for individuals and businesses in Kenya, and the Mombo Sacco MWallet Scheduled Payment feature is here to transform the way you handle your financial obligations. In this article, we’ll explore how this innovative feature can enhance your financial planning, offering convenience, discipline, and peace of mind.

Streamline Your Bill Payments in Kenya

Are you tired of juggling multiple bills every month? The Mombo Sacco MWallet Scheduled Payment feature simplifies your financial life by automating bill payments. Whether it’s electricity, water, school fees, or loan repayments, you can schedule payments to occur on specific dates. By doing so, you eliminate the stress of remembering due dates and avoid late payment penalties, keeping your financial record in good standing.

Boost Your Financial Discipline

Developing financial discipline is vital for achieving financial goals. The scheduled payment feature helps you prioritize expenses by automatically setting aside funds for future payments. This promotes disciplined saving and spending habits, which contribute to long-term financial stability. By aligning your finances with your goals, you can build a robust financial future.

Experience Peace of Mind

In today’s fast-paced world, the comfort of knowing your finances are under control is invaluable. Mombo Sacco MWallet’s Scheduled Payment feature provides peace of mind by automating routine financial tasks. You can rest assured that your bills are paid on time, allowing you to focus on personal and professional pursuits without financial stress.

Save Time with MWallet in Kenya

Time is a valuable resource, and the Mombo Sacco MWallet Scheduled Payment feature helps you save it. Instead of spending hours managing manual transactions, automate your payments and reclaim your time. This increased efficiency allows you to devote more energy to enhancing productivity in other aspects of life.

Optimize Your Budget with Scheduled Payments

A well-structured budget is the cornerstone of sound financial planning. By leveraging the MWallet Scheduled Payment feature, you can systematically allocate funds and ensure that your spending aligns with your financial objectives. Recurring transactions provide valuable insights into your spending patterns, helping you refine and optimize your budget over time.

Cultivate Sustainable Financial Habits for Kenyans

Building strong financial habits today is essential for securing a prosperous future. The Mombo Sacco MWallet Scheduled Payment feature helps cultivate these habits, preparing you to manage various life events, investments, and unexpected expenses. Incorporating this feature into your financial routine garners lasting benefits for your financial well-being.

Conclusion: Embrace Financial Innovation with Mombo Sacco MWallet

The Mombo Sacco MWallet Scheduled Payment feature is a game-changer for Kenyans seeking to elevate their financial management practices. By offering streamlined bill payments, enhanced discipline, peace of mind, and time efficiency, this feature empowers you to achieve your financial goals with confidence. Embrace this cutting-edge solution to unlock a seamless financial journey with Mombo Sacco, your trusted partner in financial success. Start using the Mombo Sacco MWallet Scheduled Payment feature today and experience the benefits of a well-managed financial life in Kenya.

Enhancing Financial Inclusion: The Role of Mombo Sacco Goal Savings Accounts in Kenya Introduction Financial inclusion remains a critical focus in Kenya’s socioeconomic landscape, with efforts aimed at ensuring that

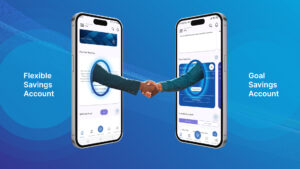

Exploring the Intersection between Mombo Sacco Goal Savings Accounts and Flexible Savings Accounts Introduction Mombo Sacco has established itself as a leader in innovative financial solutions, offering both Goal Savings

Fostering Social Cohesion through Mombo Sacco Goal Savings Accounts Introduction In today’s fast-paced society, financial goals and savings are often seen as individual pursuits. However, Mombo Sacco’s Goal Savings Accounts

Download the Mombo app and follow the simple steps to register in minutes.