Comparing Mombo Sacco Goal Savings Accounts to Forex Trading

Comparing Mombo Sacco Goal Savings Accounts to Forex Trading: Navigating Financial Choices in Kenya In recent years, Kenyans have embraced a wide array of financial

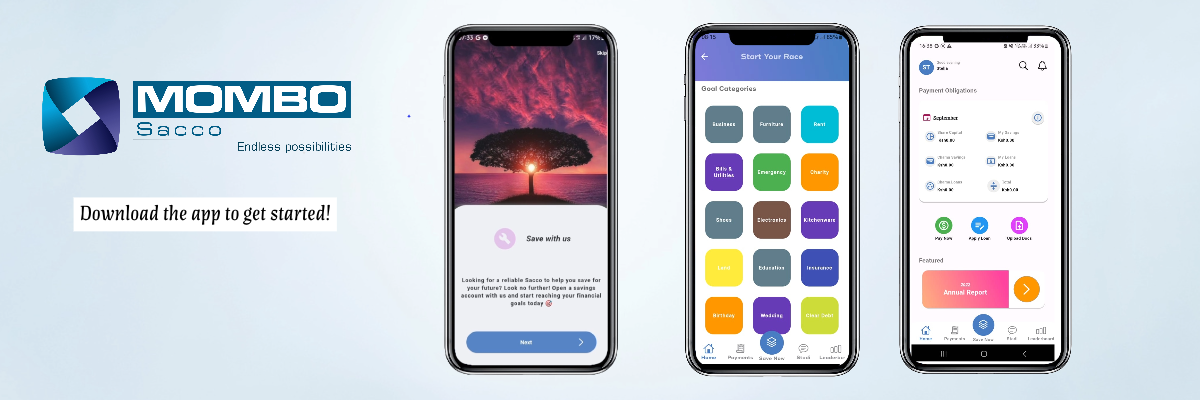

Kenya has emerged as a leader in digital wallets, with platforms like M-Pesa transforming financial transactions. Among numerous options, the Mombo Sacco MWallet distinguishes itself with unique features tailored for individuals and businesses. Here’s why the Mombo Sacco MWallet is your best choice for a digital wallet in Kenya.

Unmatched Cost Savings

A standout feature of the Mombo Sacco MWallet is its significant transaction fee savings. Users can enjoy fee reductions ranging from 20% to 50%, providing an economic advantage few other digital wallets can match. By lowering transaction costs, the Mombo Sacco MWallet ensures you can maximize your financial growth, making it an ideal choice for those aiming to achieve their financial goals.

Integrated Banking and Mobile Money Solutions

While most digital wallets focus primarily on mobile money, the Mombo Sacco MWallet offers seamless integration with both banking and mobile money accounts. This dual functionality allows effortless fund transfers across different financial channels, offering unmatched convenience and flexibility. Whether transferring money to a bank account or topping up your M-Pesa, the MWallet simplifies the process, enhancing user experience.

Enhanced Security and 24/7 Accessibility

Security is a top priority in today’s digital world. The Mombo Sacco MWallet employs advanced security features, ensuring your financial data and transactions remain protected at all times. With 24/7 access and real-time notifications, you maintain complete control and awareness of your account activity. This commitment to security and accessibility sets MWallet apart, providing peace of mind to users seeking a trusted digital wallet.

Comprehensive Financial Management Tools

Beyond standard transaction features, the Mombo Sacco MWallet offers an array of financial management tools. With integrated planning, budgeting features, and payment scheduling options, the app fosters sound financial practices and strategic management. These additional tools support informed financial decision-making, encouraging growth and stability for users. Recognizing the needs of small and medium-sized enterprises (SMEs), the Mombo Sacco MWallet includes a specialized SME Biashara account. This account facilitates business transactions with zero monthly maintenance fees and offers benefits such as bulk payments and multi-level transaction approvals. For Kenyan SMEs seeking a reliable financial partner, the Mombo Sacco MWallet presents unmatched value and support.

Conclusion: Empower Your Financial Future with Mombo Sacco MWallet

In a crowded digital wallet market, the Mombo Sacco MWallet stands out by providing a comprehensive, secure, and cost-effective solution tailored to the dynamic needs of both individual and business users. Its unique features and commitment to financial literacy and growth make it an indispensable tool for navigating Kenya’s financial landscape effectively. Choose the Mombo Sacco MWallet and embrace an empowered financial future by selecting a digital wallet designed to cater to your diverse transactional needs in Kenya.

Comparing Mombo Sacco Goal Savings Accounts to Forex Trading: Navigating Financial Choices in Kenya In recent years, Kenyans have embraced a wide array of financial

Empowering Growth: The Efficacy of Mombo Sacco Goal Savings Accounts for Kenyan SMEs and MSMEs Introduction Small and Medium Enterprises (SMEs) and Micro, Small, and

Empowering Kenyan Youth: How Mombo Sacco Goal Savings Accounts Align with Youth Saving Objectives Introduction Kenya’s youth represent a vibrant and dynamic segment of the

Download the Mombo app and follow the simple steps to register in minutes.